Using Excel Mileage Calculator VS Using a Mileage Calculator App in 2020

30 Jul, 2020Using a Paper or Excel Mileage Calculator VS Using a Mileage Calculator App in 2020

For decades, independent contractors known for business had no way of tracking their mileage other than keeping pen-and-paper mileage log books. Not only was writing information for every business mile traveled a hassle; It also left tax filers for errors that could cost them hard work. Fortunately, now there are other options for keeping your mileage report.

Of course, using a phone or computer to track sensitive tax information can be an intimidating task, especially if you have not been particularly tech-savvy or used technology for this purpose in the past. This is why we are providing you the basic information needed to know how to track your profit using modern methods.

Should I Be Tracking My Mileage?

If you are self-employed and drive for work purposes, you are entitled to reimbursement from the IRS for your business benefits. Jobs that meet the tax return criteria include, but are not limited to, independently working riders, delivery drivers, salespersons, medical workers, real estate agents, and others. Miles operated for the purpose of donating or moving forward may also qualify for reimbursement.

However, keep in mind that, in most circumstances, coming from your home to your regular workplace does not count as a business benefit. You are only considered to run business miles when you are traveling from one workplace to another.

Advantages of a Digital Mileage Log or Mileage Tracker

In addition to the obvious benefits of saving time and reducing hand fatigue, the use of technology to track your gains comes with many advantages. Being naughty and more legible than handwritten notes, digital mileage logs make it easier to correct errors.

Additionally, the ability to store and download reports quickly, as you need them, means that your mileage files are not lost. And, you don’t have to spend hours through each drawer of your house when the tax season rolls around. These factors help ensure that your tax paperwork is correct and can potentially save more money than you expect.

Google Sheets & Excel Mileage Log

Creating a mileage sheet using Excel is a popular choice among many drivers. When logging a business trip in this way, it is necessary to ensure that your information is accurate, detailed and consistent with the IRS mileage log. Your log should pay attention to each trip you took, listing how many miles you traveled, where you went, and the date you traveled. It is also recommended that you track your personal trips to make it easier to calculate the number of business miles you run during the year. Our free mileage log template provides a direct format for you to list this information.

However, while Excel and Google Sheets are an effective way to store your information neatly and back it up in case of an emergency, this method has its downsides. It is difficult to update a spreadsheet on a small phone screen, so you will still need to run down notes as you drive and later type the information on your computer. At the end of the day, it can be time consuming, and everything you write can get lost in the transcription process. That is why we recommend using the mileage tracker app instead.

How to Use a Mileage Tracker App to Track Your Mileage

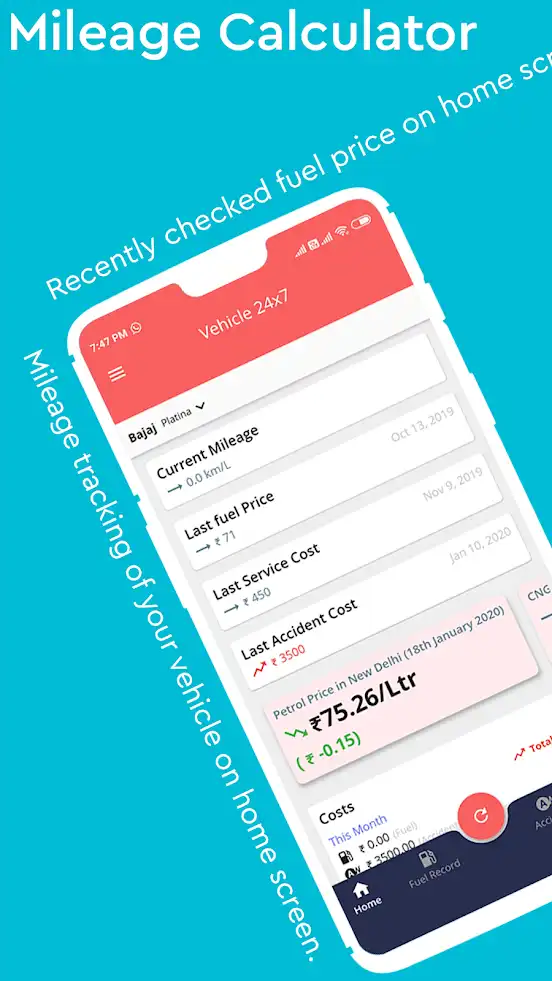

Using a mileage tracker app like Vehicle 24x7 is the easiest way to track business mileage. You just need to download the app, complete the initial launch process and start driving. Even when the app is closed, your phone will automatically detect when you are driving. Your only responsibility is that you can classify your trip as business or personal. If necessary, you can further customize your personal settings to track miles in the way that makes the most sense for you.

To make all your business expenses more manageable, you can connect your bank account or credit card to the Vehicle 24x7 app and keep your spending details and photos of receipts at all locations. This allows you to record all costs associated with vehicle maintenance, tolls, parking, and other expenses that may be tax-deductible for you.

However, you choose to use it, Vehicle 24x7 offers you a simple, foolproof way of creating mileage logs to save both time and money. You are likely to keep your phone with you at all times anyway. So why can’t it also track your business miles and get you out of the trouble of writing everything?