Why Everyone Should Use A Mileage Calculator App

01 Jan, 2020Why Everyone Should Use A Mileage Calculator App

It is no secret that tracking the profit of your business can save you money tax season. Whether you are a small business owner or a salesman, a freelancer or an online shop owner, you leave money on the table every time you use your car for work and do not track your mileage. Have been.

The benefits of tracking your miles

All business miles are deducted on your tax return. Whenever you drive for business purposes, you can use that journey to your advantage by claiming mileage deduction. Whether you drive to a ride-sharing company, such as Uber or Lyft, work in field sales, meet clients regularly or provide in-home services, keeping track of your mileage tax Saves.

There are two different ways to claim a deduction. The first thing hinges on one thing: the IRS standard mileage rate. In an effort to make deductions easier for business owners, the IRS lets you use a flat rate to calculate the value of your deduction. The rate varies from year to year, but the standard benefit rate in 2019 is $ 0.58. This means that for every thousand miles you run, you can deduct $ 580 from your taxes! Note that driving to and from work is not.

Another option is to cut down on the actual expenses related to your vehicle. Which includes things like lease payment, fuel cost and insurance. You can deduct the portion of expenses that apply to your business miles. By tracking your profit, you can quickly determine which method is more profitable for your situation. Run your records for miles and multiply by the standard mileage rate. If this number exceeds the cost of your actual expenses, it is better to claim the standard benefit deduction.

With the variety of simple, easy-to-use Mileage Calculator applications are available today. The days of ingesting anything from notebooks to receipts to fast food napkins to miles are over. A new generation of software is available to you that allows you to keep detailed, systematic records directly from your phone.

Mileage Calculator apps remove the guesswork

Using the Mileage Calculator app makes it easy to record your business mileage correctly every time. There is no estimate to see or lose your notes, no over-estimated or forgotten expenses, no more uncertainty.

Since mileage malculator via an app is automated, you don’t have to spend extra effort to remember to travel or stop your miles when you’re in a hurry and stop your mileage.

When you turn on an easy, simple and efficient mileage calculator app and drive, it runs silently in the background you just need to add some information about your car details, this allowing you to keep your eyes and mind on the road. By focusing less on the mundane details of recording your mileage, you are free to look at the big picture and do the best job for your business. An app can ease some of the stress of day-to-day reporting so that you can use your mental energy for the things that are needed.

A mileage calculator app can increase productivity

When you feel less involved in reporting and administrative tasks, you are more independent for your business. Imagine what you could do if you were less influenced by administrative tasks.

If you are a real estate agent, you may have to move around to show houses, meet clients and buy gifts. Every time you take a trip, every trip has to be written.

A mileage calculator app can help you do “smarter, not harder work” to free up your mind to add valuable time to your day and focus on your work instead of doing administrative work.

Choosing the right mileage calculator app for you

There are a multitude of different options to choose from when seeking a mileage calculator app. You can also find some of the free options that limit your number of trips per month to paid services that track every mile, all the time, and allow you to classify your trips accordingly.

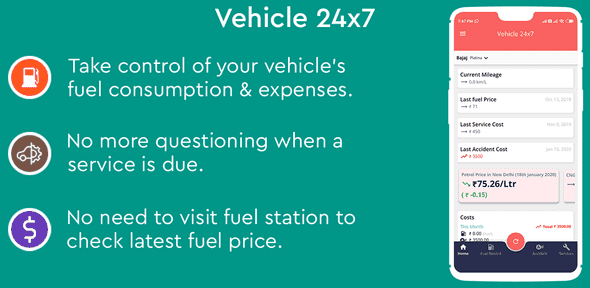

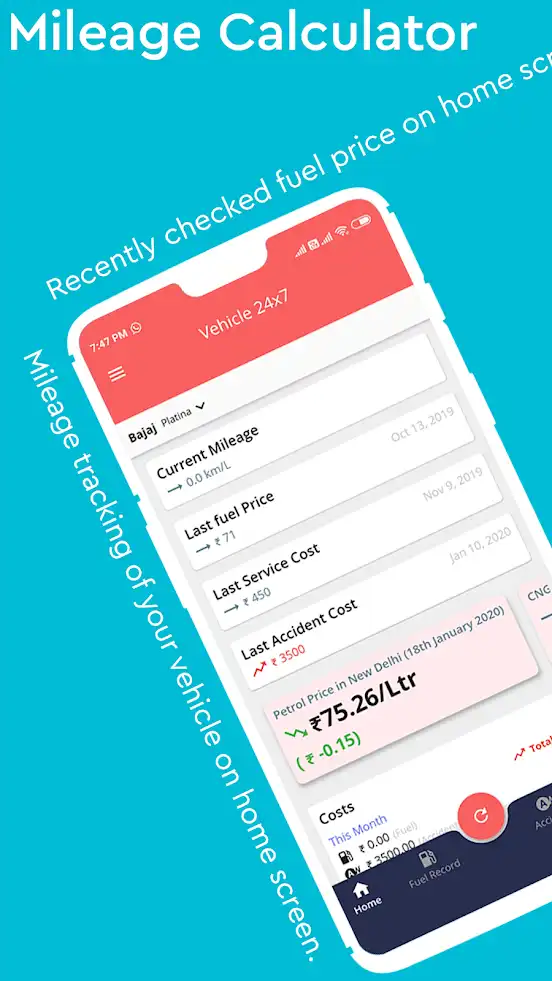

Vehicle 24x7 is an intuitive, user-friendly app that allows quick and easy tracking of miles. While there is a free version.

Our app also allows enable you to add other expenses like parking and toll expenses as needed. Plus, the app also offers you many other features so you keep the details recorded of your car.

Many apps offer mileage calculator, but any app you choose, using one is always the best option. mileage calculator apps ensure that you keep accurate, detailed, IRS-compliant records at your fingertips and help put money back into your pocket through business benefit tax deductions.

Do not wait anymore! Check your options, and start tracking your mileage!